I recently got into Bitcoin, and it’s been capturing my attention. As the web is, full of “Bitcoin 101” posts, I thought for this piece I’d touch on some of the more interesting stuff. But, quickly, a short primer.

Bitcoin: What / Who / Where / When / Why / How

What is it – digital money.

Who created it – seriously, nobody knows!

Where do you use it – anywhere that accepts it.

When do you use it – when traditional financial systems get in your way.

Why use it – because a traditional financial system got in your way once.

How do you get it – from someone who has it.

With that out of the way… Bitcoin was created because someone was sick of dealing with banks and their fees. Exchange rates. Fear of hyper inflation. Central bankers seemingly reckless and authoritarian rule. To name a few.

The dream was a new monetary system, that was basically the opposite of the present system. Bitcoin had to be owned by the people who used it. There is no central bank. No one guy who calls the shots. Really, what this means, is that someone can’t decide to print more money.

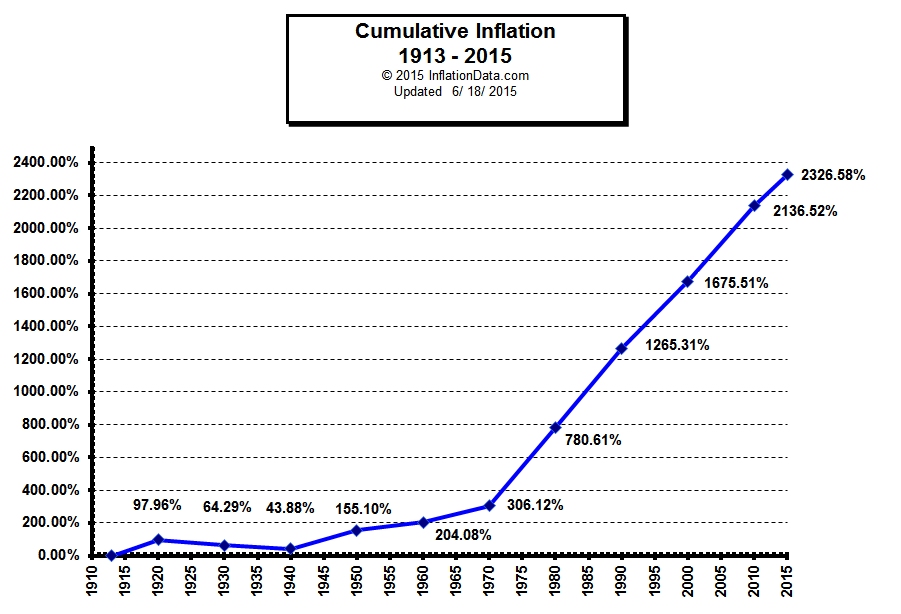

Remember when the US decided to move away from the gold standard? Inflation was suddenly relevant.

Bitcoin was designed to mimic a precious metal. Precisely so inflation was not a thing. In fact, it was designed to be deflationary. Just like a meal is. Like gold for example, where there is a finite amount on the planet, there is a finite amount of Bitcoin. 21 million coins to be exact. And just like mining for gold, the process of issuing new bitcoins into the domain is also called mining. Another interesting fact about gold, is that can be lost forever. Like when a pirate buries a chest and his parrot eats the treasure map. You could then say, arrrrr, I mean… you could say that the total amount of gold in the world went down, thus driving prices up. Supply and demand. The same thing is possible with bitcoin. Someone could forget the password to their wallet. Effectively loosing those bitcoins forever (there are no provisions for the traditional “forgot password” reset).

Ever try sending money to someone out of country? How long did it take, and how much fees did you pay? Probably a few business days, and about 10% after exchange rates and transfer fees. With Bitcoin, that changes to seconds, and around 2% after exchange rates.

How about being at a restaurant and noticing that their “machine” is down. And then noticing that the ATM is corner is conveniently online and ready to help. After a $5.50 service fee, you have your cash. But oh no, your bill is $32.65. You either leave $40 and deal with tip remorse for the rest of the day, or ask for change and have to deal with a bunch of metal for the rest of your life when it drops into your car seat on the way home. With Bitcoin, not an issue, as there is no machine. All that you and the merchant need is an internet connection. Transfer any amount, in seconds, for free. You save the ATM fee, and the merchant saves the 2% Visa would have charged him if the machine were online.

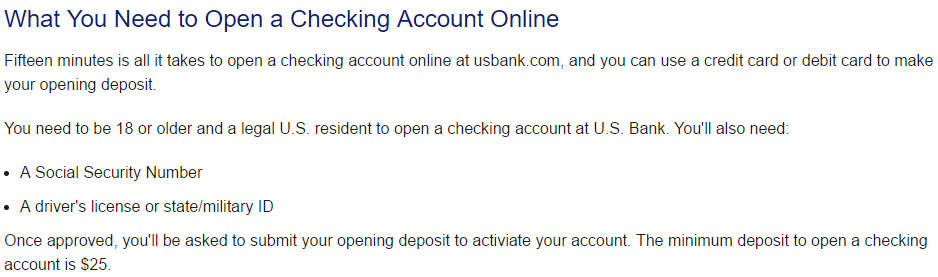

One really interesting thing about Bitcoin is that you do not need to be human to own it. Think about that. First, lets take a step back. To open a bank account you have to first be human. You have to have an ID. You have to basically prove to the bank that you’re bank material. Surprisingly, this is not as trivial as it sounds. Something like 7% of Americans (21 million people) are considered un-banked. Meaning they don’t have a bank account.

Live in a first world country, and the requirements are easier to meet. Harder elsewhere. About 2B people in the world are un-banked. A Bitcoin account is nothing more than an app on your phone. Anyone can download a Bitcoin wallet and immediately gain access to the currency. A person can get paid from an employer, right to their Bitcoin wallet, turn around and pay out to service providers. Bitcoin can be (in some countries, right now, actually is) a solution for those people.

Take Latin America for example. The whole region is dealing with arguably its worst economic crisis ever. Thanks to low oil prices, and the Chinese stock market crash, these countries are printing money to deal with deficits. Bitcoin holders in 2015 saw their coins perform more than 400% better than the Venezuelan Bolivar. Further, Bitcoin preformed 92% better than the Brazilian Real, more than 65% better than the Mexican Peso, and more than 41% better than the Argentine Peso. This is a threat not only for locals in these countries, but for foreign nationals working abroad, sending money home (remittance), and even for tourists.

The remittance industry is an interesting one. The stat is something like 10B US equivalent dollars is spent on fees alone every year. That money could have serious impact if it made it back home. A Bitcoin transfer from someone in Canada, back home, to the Venezuela, takes seconds and is virtually free. In these countries, an industry is popping up around currency conversion. Say the person in the Venezuela received a Bitcoin transfer and now needs to spend it on bread. They could ether find a merchant would accepted Bitcoin (Latin American merchant transactions finished 2015 having grown by 1,747% year-over-year), or, thanks to this new industry, have someone come to them to exchange their Bitcoin for Bolivar’s. Exchange rates for these services are about 1%.

Any way, huge tangent, I know.

Back to the being human part. You do not need to be human to own Bitcoin. Software can own Bitcoin. Imagine this. An electric autonomous car, who works as a taxi. Get’s paid in Bitcoin from it patrons. Drives itself to the (also autonomous) recharge station to fill its batteries, pays in Bitcoin. Drives itself through the automatic car-wash, pays in Bitcoin…etc. Imagine a robot filing taxes, just like you. Neat stuff!

Ok, ok. I’m sold. How do I get Bitcoin? This is the part, when I unfortunately have to mention Bitcoin’s infancy. Its been said, Bitcoin is now where e-mail was 20 years ago. 20 years ago, to send an email, you needed to be intimate with computers, programming, and TCP/IP. Today, you need an iPad and WiFi. Bitcoin today does not have an iPad or WiFi. Although it is getting better all the time. Probably the easiest way to actually acquire Bitcoin is, I’m ashamed to say, from an ATM machine. Yes, you’ll pay the same $5.50 service fee. But right now, it’s the easiest way to acquire Bitcoin.

Bitcoin’s WiFi is the online currency exchange. This is currently one of Bitcoin’s biggest growth areas. In theory, you link your bank account to the exchange, and then simply transfer money from your savings account into your Bitcoin wallet. The exchange acts like a middle-man. He accepts dollars, Pesos, whatever, holds back a transaction fee, and then issues bitcoin. Some of the better exchanges have built up the infrastructure to do this. However, their service is clunky and limited. Lots of room to improve. Another way to get Bitcoin, is simply to ask someone who has it. An employer, a friend, a person buying your used TV. Same way you’d acquire traditional money.

Ok, ok. I’m sold. Now that I have Bitcoin, where do I keep it?

Bitcoin’s iPad is the Bitcoin Wallet. This is probably the easier of the two technologies to accomplish, and thus wallet technology is further along in its development path. Keeping it simple, a wallet is just an app on your phone/tablet/computer. It has a unique address, which anyone can use to send you Bitcoin, and allows you to send Bitcoin out by typing in the address of someone else’s wallet. While you were reading this, I just sent Bitcoin to my friend in Nepal. And he’s texted me back saying that he’s having a great time at the bar, buying beers with the Bitcoin I sent. Not sure I would even know how to do that without Bitcoin.

In summary, Bitcoin is an alternative to traditional FIAT currencies. It allows anyone in the world to participate. And if anything, it introduces serious competition into the global finical system.

Quoting Andreas Antonopoulos, a Bitcoin evangelist:

“Bitcoin, and the concept of the internet of money that it creates, are this new model for a payment network that spans the globe, that has no borders, very much like the internet, that allows you to run financial applications that are controlled by software and, rather than political rules, are controlled by mathematical rules. The fact that the network can process payments as small as hundredths of a penny or as large as billions of dollars will enable all kinds of applications that are impossible with the traditional financial system.”

Check out Part-2 of this article for a deeper look into the underlying technology.